The Reserve Bank has tied the future of monetary policy to the restoration of wage growth. But how likely is that, and what are the consequences?

The Reserve Bank is going all out for wage growth “sustainably above 3%” — the kind of wage growth Australia hasn’t seen for the best part of a decade.

It has already committed itself to achieving an “actual” inflation target, sustainably between 2% and 3%, saying it won’t lift its cash rate until that happens.

That’s a substantial hardening of its earlier target, which was to merely see “progress towards” an inflation rate of 2% to 3%.

In board minutes released last week it says that to get inflation to 2-3% it is likely wage growth will have to be “sustainably above 3%” — well above where it has been for the past seven years.

The bank received encouragement last Thursday with news of an extra 88,700 Australians in work and a dive in unemployment rate from 6.3% to 5.8%, but its minutes say that for wages to climb to where it wants them, tightness in the labour market would need to be “sustained”.

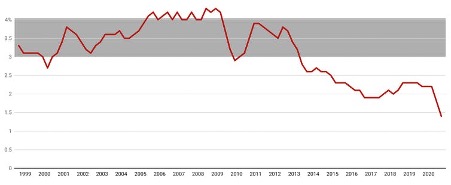

Actual wage growth, low for years

Wage price index, total hourly rates of pay excluding bonuses, private and public, annual. ABS

It means monetary policy (interest rates) is tied to a recovery in wage growth, something about whose timing we’ve little idea.

Things aren’t as simple as the bank suggests

For decades now macroeconomic policy in Australia (and elsewhere) has been built around the idea of a stable relationship between the level of unemployment and the rate of inflation of both wages and prices – the so-called Phillips curve, named after the economist (and engineer) who first measured it.

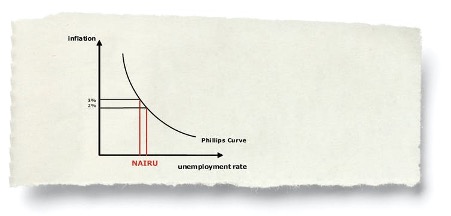

The target rate of unemployment, the “non-accelerating inflation rate of unemployment” (NAIRU) is then defined as the rate of unemployment consistent with achieving an inflation target, in the case of Australia’s Reserve Bank, low and stable rate inflation of 2-3%.

It is further assumed that the NAIRU is equivalent to reaching full employment, and that aggregate demand will then be equal to the potential output the economy is capable of producing, so that there is no output gap. Accordingly, at that point macroeconomic policy should be neutral, neither adding nor subtracting from aggregate demand.

But what the simple graphs above don’t acknowledge (and the Reserve Bank has also been slow to acknowledge) is that the relationships between unemployment, inflation, and the output gap change over time.

Between 2011 and 2019 the bank persistently overestimated annual wage growth by about 1 percentage point as actual wage growth steadily declined from about 4% to around 2%, and now to 1.4%.

Nevertheless, despite its poor forecasting record, bank staff continued to suggest that NAIRU had changed little and was close to 5%.

Then in mid 2019, the bank announced that it had revised down its estimate of NAIRU to 4½%.

There was a “two-thirds chance that the current NAIRU is between 4% and 5%, and a 95% it is between 3½% and 5½%”.

And most recently Governor Philip Lowe said it was “certainly possible that Australia can achieve and sustain an unemployment rate in the low 4s, although only time will tell”.

To my mind, these changes in the NAIRU are based on the convenient assumption that lower wage increases must, by definition, reflect a lowering of the NAIRU.

But there are reasons to believe that much of the stagnation in wages growth is due to things other than the degree of slack in the labour market.

Lowe himself acknowledged in his speech “there are some powerful structural factors at work”.

He cited

- ‘increased competition in goods markets, which makes firms very conscious of cost increases

- the trend towards more services being provided internationally

- advances in technology, which have reduced the demand for some types of skills and increased the demand for others

- changes to the global supply of labour and regulation of labour markets’.

I agree, particularly with the last two points. But what the bank doesn’t seem to have accounted for is the way in which these structural factors have changed the distribution of income and the likely distribution of wage rises.

Low wage rises for low earners hurt us

Macroeconomic measures of the kind being talked about — interest rate and spending and tax adjustments — are indeed likely to accelerate wage growth. However, because of these structural changes, shortages are likely to emerge for skilled workers, while there continues to be an excess supply of unskilled workers.

Consequently, if the authorities rely only on conventional macroeconomic measures, the wages for the (already higher earning) workers who have skills in demand will be boosted much more than for other workers.

And because high earners generally save more of what they earn than low earners, macroeconomic measures of the kind being talked about are likely to push up aggregate wage growth without boosting economic activity as much as is possible. Inflation may have been boosted sufficiently to reach its target level, but without fully employing the population and there will be an enduring gap between aggregate demand and potential output.

Eventually, in response to this inadequate demand, private sector investment is likely to sink. This will result in less innovation and therefore lower productivity growth, lowering what the economy is capable of.

It’s the sort of situation Australia (and other advanced economies) were in before the COVID recession. In the United States it was called “secular stagnation”.

We need to actively push up low wages

To avoid it we will have to rely on more than standard macroeconomic demand management to boost wages.

The best place to start would be to boost spending on education and training to improve the skills and earning power of people in middle and lower-level jobs, and better suit skills to needs.

This would lower the long-term structural unemployment in the economy, and boost both demand and the productive capacity of the economy; all without adding to inflation.

It would also help if the government stopped its resistance to wage increases, starting with the removal of public service wage freezes.

This is a slightly modified version of an article that first appeared in The Conversation.

Michael Keating is a former Secretary of the Departments of Prime Minister and Cabinet, Finance and Employment, and Industrial Relations. He is presently a visiting fellow at the Australian National University.

Comments

6 responses to “The Reserve Bank’s target for wage growth is difficult whilst the Government resists wage increases”

From as far as I can see, alot of the problems we have aren’t exclusively to do with low wage growth (although that is an important factor, just not the whole picture imo), and consequently while we need actual wage growth, I don’t think that approach alone will save the economy.

I feel it’s largely to do with our increasing reliance on casual employment.

Correct me if I’m wrong (these are mostly my assumptions), but I feel that casual employment was never intended to be a person’s primary source of income, I’d imagine it was supposed to be a little extra income on TOP of your full / part time salary, which I feel is mainly why initially, there weren’t alot of benefits; no penalty rates, no paid time off and cease employment without notice / reason / severance package, but a higher immediate wage compared to the same position but full / part time.

But I don’t think that was ever going to be the case, as we always had an unemployment rate of 4 – 6%, there were always going to be people who took casual employment as their sole job, and since it’s effectively work as much as the employer needs, rather than as many hours as the employee needs, on top of the aforementioned benefits, the majority of which are benefits for the employer, paired with a high supply of workers (4 – 6% of the ready-to-work population at the WORST (for employers) of times) contributing to ever stagnating wage growth, I can’t help but feel like we need to get rid of casual employment entirely.

I absolutely may have misunderstood how it all works and contributes to the system, but at this point in time this is a part of what I feel is wrong with Australia’s workforce.

Economics is not a science nor a discipline. It is a cover for exploitation. By having such imposing nonsense, we obscure history with theory. CONfusing.

Look at the Irish banks? The EU had to allow an extraordinary measure: a government grant to persons who made deposits to the banks, over a period of years. In a few years, the banks failed, with much larger debts, as a result of growth exhorted by th regulator, of up to 30% a year in lending, mostly for housing and development land. The EU appears surprised by that…. all those terribly talented economists.

Is this being taught as part of economics courses? I doubt it. We are firmly in the grip of those who ‘know’ all about lending. Admittedly, Australia is bette placed than most countries. Well led perhaps?

This government, ardent supporters of supply-side economic solutions, will never stop resisting wage increases. Indeed, they are actively doing everything in their power to lower wages. They removed penalty rates; support the ‘gig economy’; do nothing meaningful to ensure a minimum farm worker’s wage; fight tooth and nail to suppress transfer payments, especially to unemployed folk; and, more pointedly, do everything they can to increase the earnings of the wealthy (various subsidies, tax cuts/breaks, deregulation, lax oversight mechanisms). Remember, they ‘worship’ Thatcher/Reagan, and, by extension, the Hayek/Friedman school of economic philosophy. No hope!

Hayek is not a crusher of people!

Increasing the earnings of the wealthy is best done by the multiplier… it worked in the 1930s and I find it sinister that ecoomists and those they advise neglect it. The velocity of money is moribund and pumping money into housing will not help.

Wages and salaries for projects will reheat this crucial aspect: the poor spend what they have! That is why they are the poor…

The golden rule in international finance is *don’t fight the FED” Jerome Powell, Director of the Federal Reserve Board of America, (the FED) has been making consistent announcements that interest rates will be held at current levels until 2024. Our RBA takes its que from the FED. The RBA data has to be arranged to suit the narrative of the FED. This was fair enough when our economy mirrored the USA. But since 2007/08 everyone must see, there is a decoupling of our economy from the US towards East Asia.

This is being accentuated by East Asia’s handling of corvid-19 compared with the US. The US is in deep strive so Jerome Powell’s policy settings is probably appropriate for the States, but here, this low interest rate policy is fueling a massive asset bubble that will end in a destructive crash! Government policy is the only way to stimulate productive growth, Not the RBA ,it wont work!